-

Cryptocurrencies

-

Exchanges

-

Media

All languages

Ethereum (English: Ethereum) is an open source public blockchain platform with smart contract functions. Through its dedicated cryptocurrency Ether (also known as "Ether"), it provides a decentralized virtual machine (called the "Ethereum Virtual Machine" Ethereum Virtual Machine) to process peer-to-peer contracts.

The concept of Ethereum was first proposed by programmer Vitalik Buterin between 2013 and 2014 after being inspired by Bitcoin. ICO crowdfunding was able to start developing.

As of June 2018, Ethereum is the second-highest cryptocurrency by market value, and Ethereum is also known as the "second-generation blockchain platform", second only to Bitcoin.

Compared to most other cryptocurrencies or blockchain technologies, the features of Ethereum include the following:

Smart contract (smart contract): a program stored on the blockchain, run by each node, requires The person who runs the program pays the fee to the miners or stakeholders of the node.

Tokens: Smart contracts can create tokens for use by distributed applications. Tokenization of distributed applications aligns the interests of users, investors, and administrators. Tokens can also be used to conduct initial coin offerings.

Uncle block: Incorporate the shorter block chain that has not been included in the parent chain in time due to its slow speed, so as to increase the transaction volume. The related technique of directed acyclic graph is used.

Proof-of-stake: Compared with proof-of-work, it is more efficient, can save a lot of computer resources wasted in mining, and avoid network centralization caused by special application integrated circuits. (Under testing)

Branch chain (Plasma): use smaller branch block chain operations, and only write the final result into the main chain, which can increase the workload per unit time. (Not implemented yet)

State channels: The principle is similar to Bitcoin's Thunder network, which can increase transaction speed, reduce the burden on the blockchain, and improve scalability. Not yet implemented, the development team includes Raiden Network and Liquidity Network.

Sharding: reduce the amount of data that each node needs to record, and improve efficiency through parallel computing (not yet implemented).

Distributed applications: Distributed applications on Ethereum do not go down and cannot be shut down.

Development history

Ethereum was originally proposed by Vitalik Buterin in 2013. Vitalik was originally a programmer participating in the Bitcoin community. He once advocated to the Bitcoin core developers that the Bitcoin platform should have a more complete programming language for people to develop programs, but did not get their consent, so he decided to develop a A new platform is used for this purpose [8]:88. Buterin believes that many programs can be further developed using principles similar to Bitcoin. Buterin wrote the "Ethereum White Paper" in 2013, stating the goal of building a decentralized program. Then in 2014, funds for development were obtained through public fundraising on the Internet, and investors used Bitcoin to purchase Ethereum from the foundation.

The original Ethereum program was developed by a company Ethereum Switzerland GmbH in Switzerland[11][12], and then transferred to a non-profit organization "Ethereum Foundation" (Ethereum Foundation).

At the beginning of the platform's development, some people praised Ethereum's technological innovation, but others questioned its security and scalability.

Bitcoin pioneered the decentralized cryptocurrency, and has fully tested the feasibility and security of blockchain technology for more than five years. Bitcoin’s blockchain is actually a set of distributed databases. If you add a symbol—Bitcoin—to it, and stipulate a set of protocols so that this symbol can be safely transferred on the database, and you don’t need to trust a third party , the combination of these features perfectly constructs a currency transmission system - Bitcoin network.

However, Bitcoin is not perfect, and the scalability of the protocol is a deficiency. For example, there is only one symbol in the Bitcoin network - Bitcoin, and users cannot customize other symbols. These symbols can represent the company's stock , or certificates of debt, etc., which loses some functions. In addition, the Bitcoin protocol uses a set of stack-based scripting languages. Although this language has certain flexibility and enables functions such as multi-signatures to be realized, it is not enough to build more advanced applications, such as decentralized exchanges. wait. Ethereum is designed to solve the problem of insufficient scalability of Bitcoin.

At the beginning of 2016, the technology of Ethereum was recognized by the market, and the price began to skyrocket, attracting a large number of people other than developers to enter the world of Ethereum. Huobi and OKCoin, two of the three major bitcoin exchanges in China, officially launched Ethereum on May 31, 2017.

Since entering 2016, those who follow the digital currency industry closely have been eagerly watching the development of the second-generation cryptocurrency platform Ethereum.

As a relatively new development project utilizing Bitcoin technology, Ethereum is committed to implementing a global decentralized and ownershipless digital technology computer to execute peer-to-peer contracts. Simply put, Ethereum is a world computer that you cannot turn off. The innovative combination of encryption architecture and Turing completeness can promote the emergence of a large number of new industries. Conversely, traditional industries are under increasing pressure to innovate, and even face the risk of being eliminated.

The Bitcoin network is actually a set of distributed databases, while Ethereum goes a step further, it can be regarded as a distributed computer: the blockchain is the ROM of the computer, the contract is the program, and the Ethereum The miners are responsible for calculations and act as CPUs. This computer is not and cannot be used for free, otherwise anyone can store all kinds of junk information in it and perform all kinds of trivial calculations. To use it, you need to pay at least computing and storage fees, and of course there are other fees .

The most well-known is the Enterprise Ethereum Alliance established in early 2017 by more than 20 of the world's top financial institutions and technology companies, including JPMorgan Chase, Chicago Exchange Group, Bank of New York Mellon, Thomson Reuters, Microsoft, Intel, and Accenture. The cryptocurrency Ether, which was spawned by Ethereum, has recently become a sought-after asset after Bitcoin.

Ethereum Foundation:

A non-profit foundation headquartered in Zug, Switzerland, this fund is the umbrella responsible for allocating resources to other institutions responsible for developing and advancing development of future cryptocurrencies shape company. The Foundation's Board of Directors consists of Vitalik Buterin (Chairman), Mihai Alisie (Vice-Chairman), Taylor Gerring, Stephan Tual, Joseph Lubin, Jeffrey Wilcke and Gavin Wood. The Foundation focuses on its overarching "mission", which is to enable operating institutions to do their day-to-day work.

Ethereum Switzerland Ltd:

A company based in Switzerland that will run part of 2014 in order to lead the launch of the Genesis blockchain. The company, which is 100% controlled by the Ethereum Foundation, plans to cease operations after the launch of the genesis blockchain.

Functional application

Ethereum is a platform that provides various modules for users to build applications. If building an application is like building a house, then Ethereum provides modules such as walls, roofs, and floors. Users only need to build blocks Building a house in the same way, so the cost and speed of building applications on Ethereum are greatly improved. Specifically, Ethereum builds applications through a Turing-complete scripting language (Ethereum Virtual Machinecode, EVM language for short), which is similar to assembly language. We know that it is very painful to program directly in assembly language, but the programming in Ethereum does not need to use EVM language directly, but high-level languages such as C language, Python, Lisp, etc., and then converted into EVM language through a compiler.

The above-mentioned applications on the platform are actually contracts, which are the core of Ethereum. The contract is an automatic agent living in the Ethereum system. He has his own Ethereum address. When the user sends a transaction to the address of the contract, the contract is activated, and then according to the additional information in the transaction, The contract will run its own code and finally return a result, which may be another transaction sent from the contract address. It should be pointed out that a transaction in Ethereum is not just about sending Ether, it can also embed quite a lot of additional information. If a transaction is sent to a contract, this information is very important, because the contract will complete its own business logic based on this information.

The business that a contract can provide is almost endless, and its boundary is your imagination, because Turing's complete language provides complete degrees of freedom, allowing users to build various applications. The white paper cites several examples, such as savings accounts, user-defined sub-currencies, etc.

Technology changes

At the end of 2013, Vitalik Buterin, the founder of Ethereum, released the first version of the white paper of Ethereum, and a group of developers who recognized the concept of Ethereum were successively summoned in the global cryptocurrency community to start the project.

During the period from December 2013 to January 2014, the work of Ethereum focused on how to activate the vision described by Vitalik in the Ethereum white paper. The team ultimately agreed that the Genesis presale was a good idea, and after long, multifaceted discussions, in order to create a proper infrastructure and legal strategy, the team decided to postpone the ethereum presale, which was originally held in February 2014.

February 2014 was a very important month for Ethereum, all aspects of Ethereum were advancing by leaps and bounds: community growth, writing code, writing wiki content, business infrastructure and legal strategy. In this month, Vitalik announced the Ethereum project for the first time at the Miami Bitcoin Conference, and held the first "Ask Us Anything" event on Reddit, and the core development team became a world-class cryptocurrency team. After the Miami conference, Gavin Wood and Jeffrey Wilcke joined Ethereum full-time, although before that they developed C++ and GO clients for Ethereum purely as a hobby.

In early March, Ethereum released the third version of the test network (POC3), and finally moved the Ethereum headquarters to Zug, Switzerland. In June, the team released POC4 and quickly moved towards POC5. During this time, the team also decided to make Ethereum a non-profit organization. In April, Gavin Wood released the Ethereum Yellow Paper, the technical bible of Ethereum, which standardizes important technologies such as the Ethereum Virtual Machine (EVM). In July, the team created the Swiss Ethereum Foundation, released POC5, started the Genesis pre-sale on the 24th, and organized the second "Ask Us Anything" on Reddit.

From July 24, 2014, Ethereum conducted a 42-day pre-sale of Ethereum, and a total of 31,531 bitcoins were raised, which was equivalent to $18.43 million according to the bitcoin price at the time, ranking the second largest at that time. crowdfunding projects. The Bitcoin address used in the pre-sale is 36PrZ1KHYMpqSyAQXSG8VwbUiq2EogxLo2, and every transfer in and out can be seen in the Bitcoin blockchain browser. Two weeks before the pre-sale, one bitcoin could buy 2,000 ethers, and the number of ethers that one bitcoin could buy decreased with time. In the last week, one bitcoin could buy 1,337 ethers. The final amount of ether sold was 60,102,216. In addition, 0.099x (x = 60102216 is the total amount of the sale) ETH will be allocated to early contributors who participated in the development before BTC financing, and another 0.099x will be allocated to long-term research projects. So there are 60102216 + 60102216 * 0.099 * 2 = 72002454 ETH when Ethereum is officially released. Since its launch, in the POW (Proof of Work) stage, it is planned that a maximum of 60102216 * 0.26 = 15,626,576 ETHs will be dug out by miners every year. After switching to POS (Proof of Stake) within 1 to 2 years, the annual output of Ethereum will be greatly reduced, and even no new coins will be issued.

The autumn of 2014 is the harvest season of Ethereum, and great progress has been made in both code and operation. POC6 was released on October 5th. This is a significant release, one of the highlights being the speed of the blockchain. Block times were reduced from 60 seconds to 12 seconds and a new GHOST-based protocol was used. In November, Ethereum hosted its first small developer conference (DEVCON 0) in Berlin.

In January 2015, the team released POC7, and in February, the team released POC8. In March, the team released a series of statements about the release of the Genesis block, while POC9 is also under intensive development. In May, the team released the last test network (POC9), codenamed Olympic. In order to better test the network, during the Olympic stage, members who participate in the test network will receive Ethereum rewards from the team. There are many forms of rewards, mainly including test mining rewards and bug submission rewards.

After nearly two rigorous tests, the team released the official Ethereum network at the end of July, which also marked the formal operation of the Ethereum blockchain. The release of Ethereum is divided into four stages, namely Frontier (frontier), Homestead (homestead), Metropolis (metropolis) and Serenity (tranquility). In the first three stages, the Ethereum consensus algorithm adopts the workload proof mechanism (POW), In the fourth stage, it will switch to the proof-of-stake mechanism (POS).

On July 30, 2015, Ethereum released the Frontier phase. The Frontier phase is the initial version of Ethereum, which is not a fully reliable and secure network. Frontier is a blank slate of the Ethereum network: an interface for mining and a way to upload and execute contracts. The main purpose of Frontier is to get mining and exchange transactions running so the community can run mining rigs, and to start building an environment where people can test distributed applications (DApps). Since the Ethereum client in the Frontier stage only has a command line interface and no graphical interface, it is the main developer at this stage. With the release of Frontier, Ethereum has also started to be traded on exchanges around the world. At the beginning of 2016, the price of Ethereum began to skyrocket, and the technical strength of Ethereum began to be recognized in the market, attracting a large number of people other than developers to enter the world of Ethereum. In addition, about 10 million ethers are mined by miners per year at this stage, which is less than the original plan of 15 million per year.

From November 9th to 13th, 2015, Ethereum held a five-day developer conference (DEVCON 1) in London, attracting more than 300 developers from all over the world. The third open conference (DEVCON 2) will be held in Shanghai in September 2016.

On March 14, 2016 (Pi Day), Ethereum launched the Homestead phase. Compared with the Frontier stage, the Homestead stage has no obvious technical milestones. It just shows that the Ethereum network has been running smoothly and is no longer an insecure and unreliable network. At this stage, Ethereum provides a wallet with a graphical interface, and the ease of use has been greatly improved. Ethereum is no longer exclusive to developers, and ordinary users can also experience and use Ethereum conveniently.

A Metropolis stage release date has yet to be determined. In the Metropolis stage, the team will finally officially release a user interface designed for non-technical users with relatively complete functions, which is to release the Mist browser. The team expects that the release of Mist will include a decentralized application store and some well-functioning and well-designed basic applications, showing the strength of the Ethereum network. The Mist browser will be very simple and easy to use, as long as you can use a normal browser, you will use Mist. On the Ethereum platform, third-party developers are developing more and more decentralized applications for ordinary users. Ethereum is not only a development platform, but also gradually becomes an application market. Both developers and users are indispensable parts.

The Serenity phase release date has not yet been determined. During the Serenity phase, Ethereum will switch from PoW to PoS. Proof of work means converting electricity to heat, ether, and network stability. But if it is not necessary, Ethereum does not want to emit too much heat due to mining, so it needs to modify the algorithm: Proof of Stake (POS). The transition of the network from Proof of Work (POW) to Proof of Stake (POS) will require a substantial transition, a transformation process that seems long-term, but it’s not that far off: this type of development work is underway. POW is a terrible waste of computing power, like democracy - the worst system among other things. Freed from the constraints of POW, the network will be faster, faster, more efficient, easier to use for new users, and more resistant to centralization of mining, etc. This could be as big a step forward as putting smart contracts on the blockchain. After switching to POS, the mining required in the first three stages will be terminated, and the newly issued Ethereum will be greatly reduced, and no new coins will even be issued.

In the stage of Ethereum 2.0, the main goal of the development team is to solve the scalability problem (Scalability) through sharding, that is, to improve the transaction processing ability of the blockchain, which is also the main goal of all blockchain projects Bottlenecks to be resolved. Expected release in late 2017.

How to get ETH?

The easiest way to get ETH is to buy it. There are many digital currency exchanges that can buy ETH on the market, but users need to choose the appropriate exchange according to their address and payment method.

Ethereum account

In the Ethereum system, state is made up of objects called "accounts" (each account consists of a 20-byte address) and state transitions that transfer value and information between two accounts. An account in Ethereum consists of four parts:

A random number, a counter used to determine that each transaction can only be processed once

The account's current Ether balance

The account's contract code, if any

br> Account storage (empty by default)

Ether (Ether) is the main cryptographic fuel inside Ethereum and is used to pay transaction fees. In general, Ethereum has two types of accounts: externally owned accounts (controlled by private keys) and contract accounts (controlled by contract code). Externally owned accounts have no code, and people can send messages from an external account by creating and signing a transaction. Whenever a contract account receives a message, the code inside the contract is activated, allowing it to read and write to internal storage, send other messages or create contracts.

Messages and Transactions

Ethereum messages are somewhat similar to Bitcoin transactions, but there are three important differences between the two. First, Ethereum messages can be created by external entities or contracts, whereas Bitcoin transactions can only be created externally. Second, Ethereum messages can optionally contain data. Third, if the recipient of the Ethereum message is a contract account, it can choose to respond, which means that the Ethereum message also contains the concept of functions.

A "transaction" in Ethereum refers to a signed data package that stores messages sent from external accounts. A transaction contains the recipient of the message, a signature confirming the sender, the ether account balance, the data to send and two values called STARTGAS and GASPRICE. In order to prevent exponential explosions and infinite loops of code, each transaction needs to place a limit on the computational steps caused by executing the code - including the initial message and all messages caused by execution. STARTGAS is the limit, and GASPRICE is the fee that needs to be paid to the miners for each calculation step. If during the execution of the transaction, "run out of gas", all state changes are restored to the original state, but the transaction fees already paid cannot be recovered. If there is gas left when execution of the transaction is aborted, then the gas will be refunded to the sender. Creating a contract has a separate transaction type and corresponding message type; the address of the contract is calculated based on the hash of the account random number and transaction data.

An important consequence of the message mechanism is Ethereum's "first-class citizen" property - contracts have the same rights as external accounts, including the right to send messages and create other contracts. This allows contracts to act in multiple different roles at the same time, e.g. a user can make a member of a decentralized organization (one contract) an intermediary account (another contract) for a paranoid user using a custom quantum proof-based blueprint. An individual who signs Porter (third contract) and a co-signing entity that itself uses an account secured by five private keys (fourth contract) provides an intermediary service. The strength of the Ethereum platform is that decentralized organizations and agency contracts do not need to care about the type of account each participant of the contract is.

Applications

Generally speaking, there are three types of applications on top of Ethereum. The first category is financial applications, which provide users with more powerful ways to manage and participate in contracts with their money. Including sub-currencies, financial derivatives, hedging contracts, savings wallets, wills, and even some kinds of comprehensive employment contracts. The second category is semi-financial applications, where money is present but also has a heavy non-monetary aspect, a perfect example being self-enforcing bounties for solving computational problems. Finally, there are entirely non-financial applications like online voting and decentralized governance.

令牌系统

链上令牌系统有很多应用,从代表如美元或黄金等资产的子货币到公司股票,单独的令牌代表智能资产, secure and unforgeable coupons, and even a token system for point rewards that has absolutely no connection to traditional values. Implementing a token system in Ethereum is surprisingly easy. The key point is to understand that all currency or token systems are fundamentally a database with the following operations: subtract X units from A and add X units to B, provided that (1) A There are at least X units prior to the transaction and (2) the transaction is approved by A. Implementing a token system is implementing such logic into a contract.

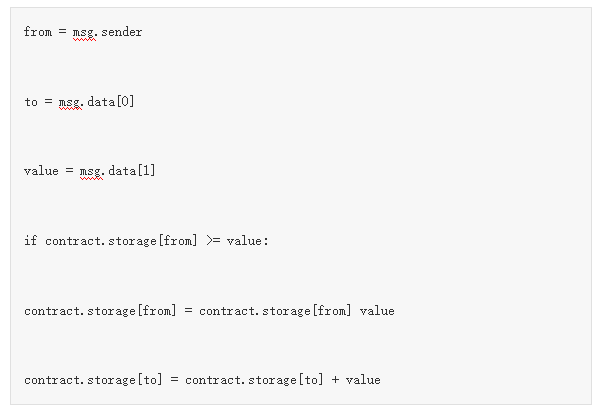

The basic code to implement a token system in Serpent language is as follows:

This is essentially a minimal implementation of the "banking system" state transition functionality described further in this article. Some additional code would need to be added to provide functionality for distributing coins in the initial and other edge cases, ideally adding a function for other contracts to query an address's balance. Will suffice. In theory, an Ethereum-based token system that acts as a sub-currency could include an important feature that a Bitcoin-based on-chain metacoin lacks: the ability to pay transaction fees directly with this currency. The way to achieve this capability is to maintain an Ether account in the contract to pay transaction fees for the sender, by collecting the internal currency used as transaction fees and auctioning them off in a constantly running auction, the contract Keep funding the Ethereum account. This way users need to "activate" their account with ether, but once there is ether in the account it will be reused as the contract will recharge it each time.

Financial derivatives and stable currencies

Financial derivatives are the most common application of "smart contracts" and one of the easiest to implement in code. The main challenge in implementing financial contracts is that most of them need to refer to an external price publisher; for example, a very high-demand application is a smart contract for hedging the price fluctuations of ether (or other cryptocurrencies) against the US dollar , but the contract needs to know the price of ether relative to the dollar. The easiest way to do this is through a "data provider" contract maintained by a particular institution (such as Nasdaq), which is designed so that the institution can update the contract as needed, and provides an interface so that other contracts can send a Message this contract to get a reply with price information.

When these key elements are in place, the hedging contract will look like this:

Waiting for A to input 1000 ETH. .

Wait for B to enter 1000 ETH.

Record the dollar value of 1000 ETH, eg $x, to memory by querying the data provider contract.

After 30 days, allow A or B to "reactivate" the contract to send $x worth of ether (re-query the data provider contract for a new price and calculate it) to A and send the remaining ether to B.

Such contracts have extraordinary potential in cryptographic commerce. One of the problems that cryptocurrencies are often criticized for is their price volatility; although a large number of users and merchants may need the security and convenience brought by cryptocurrencies, they are unlikely to be happy to face a 23% drop in assets in one day value situation. Until now, the most common proposed solution was issuer-endorsed assets; the idea is that issuers create a sub-currency for which they have the right to issue and redeem, giving them (offline) a unit of a specific underlying asset (e.g. Gold, U.S. dollars) for one unit of sub-currency. The issuer promises that when anyone returns a unit of cryptographic assets. Repatriation of related assets of a unit. This mechanism enables any non-cryptographic asset to be "upgraded" to a cryptographic asset if the issuer is trustworthy.

However in practice issuers are not always trustworthy and in some cases the banking system is too weak or not honest enough for such a service to exist. Financial derivatives offer an alternative. Instead of a single issuer providing reserves to back an asset, there will be a decentralized market of speculators betting that the price of a cryptographic asset will rise. Unlike issuers, speculators have no bargaining power on their side, as the hedging contract freezes their reserves in the contract. Note that this approach is not fully decentralized, as a trusted source of price information is still required, although this is still arguably reducing infrastructure requirements (unlike issuers, a price publisher does not require license and seems to fall under the category of free speech) and a huge step forward in reducing the potential risk of fraud.

Identity and Reputation Systems

The earliest altcoin, Namecoin, attempted to use a Bitcoin-like blockchain to provide a name registry system, where users could share their names with other The data are registered together in a public database. The most common use case is the domain name system that maps a domain name like "bitcoin.org" (or in Namecoin, "bitcoin.bit") to an IP address. Other use cases include email verification systems and potentially more advanced reputation systems. Here is the base contract that provides a Namecoin-like name registration system in Ethereum:

The contract is very simple; it is a database in the Ethereum network that can be added but cannot be modified or removed. Anyone can register a name as a value and it never changes. A more complex name registration contract would contain a "function clause" that allows other contracts to query it, and a mechanism for the "owner" of a name (i.e. the first registrant) to modify data or transfer ownership. It is even possible to add reputation and trust network features on top of it.

Decentralized storage

Over the past few years a number of popular online file storage startups have emerged, most notably Dropbox, which seeks to allow users to upload backups of their hard drives, Provide backup storage services and allow users to access to charge users a monthly fee. However, this file storage market is sometimes relatively inefficient at this point; a cursory look at existing services shows that, particularly at the "mysterious valley" level of 20-200GB, which offers neither free space nor discounts for enterprise users, mainstream The monthly price for file storage costs means paying the cost of paying for the entire hard drive in one month. Ethereum contracts allow the development of a decentralized storage ecosystem, whereby users reduce the cost of file storage by renting out their own hard drives or unused network space for a small fee.

The fundamental building block of such a facility is what we call a "decentralized Dropbox contract". The contract works as follows. First, someone divides the data to be uploaded into chunks, encrypts each chunk for privacy, and builds a Merkle tree from it. Then create a contract with the following rules. Every N blocks, the contract will extract a random index from the Merkle tree (using the hash of the previous block that can be accessed by the contract code to provide randomness), and then give the first An entity X ether to back a proof of ownership of a block at a particular index in the tree with a Simplified Verification Payment (SPV) like. When a user wants to re-download his file, he can use the micropayment channel protocol (for example, pay 1 Saab per 32k bytes) to restore the file; the most efficient method in terms of cost is that the payer does not publish the transaction until the end, but Replace the original transaction with a slightly more cost-effective transaction with the same nonce after every 32k bytes.

An important feature of this protocol is that although it looks like a person trusts many random nodes who are not prepared to lose the file, he can divide the file into many small pieces through secret sharing, and then learn about each small piece through the monitoring contract. Blocks are still held by a node. If a contract is still paying, it provides evidence that someone is still keeping the files.

Decentralized Autonomous Organization (DAO)

In general, the concept of "Decentralized Autonomous Organization (DAO, decentralized autonomous organization)" refers to a company with a certain number of members or shareholders Virtual entities relying on, for example, a 67% majority to decide to spend money and modify code. Members collectively decide how the organization allocates funds. The method of distributing funds may be bounties, salaries or more attractive mechanisms such as rewarding work with an internal currency. This essentially replicates the legal meaning of a traditional corporation or non-profit organization for enforcement using only cryptographic blockchain technology. Much of the discussion around DAOs thus far has revolved around a "capitalist" model of a "decentralized autonomous corporation (DAC)" with dividend-receiving shareholders and tradable shares; as an alternative, one has been described as An entity called a "decentralized autonomous community" would give all members equal power in decision-making and would require a 67% majority to add or remove members. The rule that each person can only have one membership needs to be enforced by the group.

The following is an outline of how to implement DO with code. The simplest design is a piece of code that can modify itself if two-thirds of the members agree. Although the code is theoretically immutable, it is still easy to get around the hurdle and make the code modifiable by putting the backbone of the code in a separate contract and pointing the address of the contract call to a modifiable storage, in a In a simple implementation of such a DAO contract there are three types of transactions, distinguished by the data provided by the transaction:

[0,i,K,V] registers changes at index i to the contents of storage addresses indexed K to v suggestion.

[0,i] registers a vote for proposal i.

[2,i] Confirm proposal i if there are enough votes.

The contract then has specific terms for each item. It will maintain a record of all open storage changes and a table of who voted. There is also a table of all members. When a two-thirds majority agrees to any storage content change, a final transaction will execute the change. A more complex framework would add built-in election functionality to enable things like sending transactions, adding and removing members, and even providing voting representatives like delegated democracy (that is, anyone can delegate another person to vote on their behalf, and this delegation Relationships are transitive, so if A delegates to B and B delegates to C then C will determine A's vote). This design will allow the DAO to grow organically as a decentralized community, enabling people to finally leave the task of picking the right person to experts, unlike the current system where experts can easily emerge over time as community members change their alignments and disappear.

An alternative model is a decentralized company, where any account can have 0 to more shares, and decisions require a two-thirds majority of shares. A complete framework would include asset management functionality - the ability to submit orders to buy and sell shares and the ability to accept such orders (provided there is an order matching mechanism in the contract). Representatives still exist in an appointed democracy, giving rise to the concept of a "board of directors".

更先进的组织治理机制可能会在将来实现;现在一个去中心化组织(DO)可以从去中心化自治组织(DAO)开始描述。 DO和DAO的区别是模糊的,一个大致的分割线是治理是否可以通过一个类似政治的过程或者一个“自动”过程实现,一个不错的直觉测试是“无通用语言”标准:如果两个成员不说同样的语言组织还能正常运行吗?显然,一个简单的传统的持股式公司会失败,而像比特币协议这样的却很可能成功,罗宾·汉森的“futarchy”,一个通过预测市场实现组织化治理的机制是一个真正的说明“自治”式治理可能是什么样子的好例子。注意一个人无需假设所有DAO比所有DO优越;自治只是一个在一些特定场景下有很大优势的,但在其它地方未必可行的范式,许多半DAO可能存在。

进一步的应用 1. 储蓄钱包。假设Alice想确保她的资金安全,但她担心丢失或者被黑客盗走私钥。她把以太币放到和Bob签订的一个合约里,如下所示,这合同是一个银行: ``` Alice单独每天最多可提取1%的资金。 Bob单独每天最多可提取1%的资金,但Alice可以用她的私钥创建一个交易取消Bob的提现权限。 Alice 和 Bob 一起可以任意提取资金。一般来讲,每天1%对Alice足够了,如果Alice想提现更多她可以联系Bob寻求帮助。如果Alice的私钥被盗,她可以立即找到Bob把她的资金转移到一个新合同里。如果她弄丢了她的私钥,Bob可以慢慢地把钱提出。如果Bob表现出了恶意,她可以关掉他的提现权限。 ``` 2. 作物保险。一个人可以很容易地以天气情况而不是任何价格指数作为数据输入来创建一个金融衍生品合约。如果一个爱荷华的农民购买了一个基于爱荷华的降雨情况进行反向赔付的金融衍生品,那么如果遇到干旱,该农民将自动地收到赔付资金而如果有足量的降雨他会很开心因为他的作物收成会很好。 3. 一个去中心化的数据发布器。对于基于差异的金融合约,事实上通过过“谢林点”协议将数据发布器去中心化是可能的。谢林点的工作原理如下:N方为某个指定的数据提供输入值到系统(例如ETH/USD价格),所有的值被排序,每个提供25%到75%之间的值的节点都会获得奖励,每个人都有激励去提供他人将提供的答案,大量玩家可以真正同意的答案明显默认就是正确答案,这构造了一个可以在理论上提供很多数值,包括ETH/USD价格,柏林的温度甚至某个特别困难的计算的结果的去中心化协议。 4. 多重签名智能契约。比特币允许基于多重签名的交易合约,例如,5把私钥里集齐3把就可以使用资金。以太坊可以做得更细化,例如,5把私钥里集齐4把可以花全部资金,如果只3把则每天最多花10%的资金,只有2把就只能每天花0.5%的资金。另外,以太坊里的多重签名是异步的,意思是说,双方可以在不同时间在区块链上注册签名,最后一个签名到位后就会自动发送交易。 5. 云计算。 EVM技术还可被用来创建一个可验证的计算环境,允许用户邀请他人进行计算然后选择性地要求提供在一定的随机选择的检查点上计算被正确完成的证据。这使得创建一个任何用户都可以用他们的台式机,笔记本电脑或者专用服务器参与的云计算市场成为可能,现场检查和安全保证金可以被用来确保系统是值得信任的(即没有节点可以因欺骗获利)。虽然这样一个系统可能并不适用所有任务;例如,需要高级进程间通信的任务就不易在一个大的节点云上完成。然而一些其它的任务就很容易实现并行;SETI@home, folding@home和基因算法这样的项目就很容易在这样的平台上进行。 6. 点对点赌博。任意数量的点对点赌博协议都可以搬到以太坊的区块链上,例如Frank Stajano和Richard Clayton的Cyberdice。最简单的赌博协议事实上是这样一个简单的合约,它用来赌下一个区块的哈稀值与猜测值之间的差额, 据此可以创建更复杂的赌博协议,以实现近乎零费用和无欺骗的赌博服务。 7. 预测市场。不管是有神谕还是有谢林币,预测市场都会很容易实现,带有谢林币的预测市场可能会被证明是第一个主流的作为去中心化组织管理协议的“ futarchy”应用。 8. 链上去中心化市场,以身份和信誉系统为基础。

以太坊矿机和挖矿收益

以太坊总量和挖矿时间

初始总量7200万,每年新增约1500万,预计2018年转为POS算法(不能挖矿),转为POS算法后,产量减少。每个区块5个币,每天产量约为4万,挖矿孤块率较高,难度为每个块调整一次。

以太坊矿机选择

选择矿机一看算力,二看功耗,三看历史口碑,包括机器稳定性、售后服务情况等。算力就是一台机器进行运算的能力,也就是这台机器能够每秒进行多少次哈希运算。目前主流比特币矿机的算力为14T,也就是每秒进行14*10^13次哈希碰撞。

如何测算显卡的性价比

简单的成本计算公式:显卡算力÷显卡价钱=每1块钱获得的算力。比如我们一张r x 5 8 0配备8 g内存的显卡,未超频挖取以太币算力是2 2 m h z / s , 价 钱 是 2 2 0 0 人 民 币 , 那 么 每 1 块 钱 获 得 的 算 力 就 是22/2200=0.01,那么超频后基本可以达到平均28.5mhz/s的算力,这样情况下每1块钱获得的算力就是28.5/2200=0.01295。

以太坊矿机的硬件

以太坊主要是使用显卡(GPU)来挖矿。需要配置一台多显卡PC来运行挖矿程序,主要硬件包含:显卡,主板,电源,CPU,内存,硬盘(推荐60G以上SSD),延长线、转接线等。其中显卡决定了挖矿的速度,主板、电源很大程度上决定矿机运行的稳定程度。

硬件准备:显卡挖矿不需要很大的PCIE带宽,主板上具备PCI-E 1X即可满足带宽要求。一般主板上具有3-5个PCI-E 1X接口,1个PCI-E16X接口,此外主板上具有大4PIN供电接口对稳定性有一定的提升。 PCI-E1X需要淘宝购买1X转16X延长线。

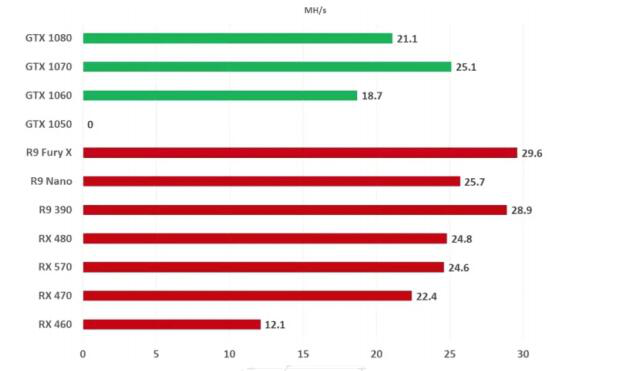

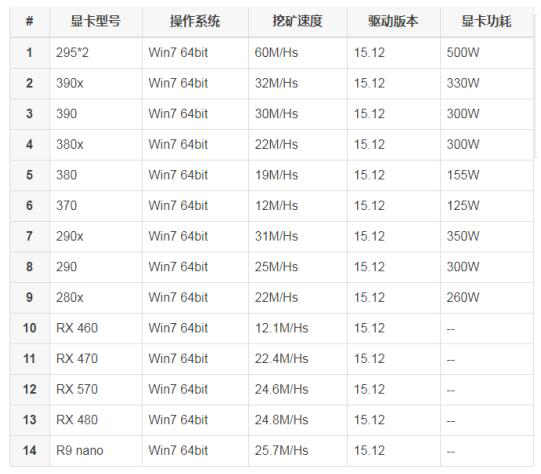

以太坊挖矿常用显卡算力表:

挖矿靠显卡核心计算,所以AMD显卡比NVIDA卡更高效。选择AMD卡,要求显卡显存大于2G,推荐购买4G显存显卡。

常见显卡的算力图示:

AMD显卡算力表:

相关资料:

以太坊发展史

https://ethfans.org/wikis/%E4%BB%A5%E5%A4%AA%E5%9D%8A%E5%8F%91%E5%B1%95%E5%8F%B2

以太坊每周更新文档

https://ethfans.org/posts/week-in-ethereum-2020-02-09