Continue to serve and expand the channel of medical technology partners. Third Generation: AENCO Prime Broker Platform.

The second-generation AENX exchange, improves the "data decay principle", starts the second-generation blockchain, supports 2-3 additional business shards, and is used for API prototypes for third-party integration.

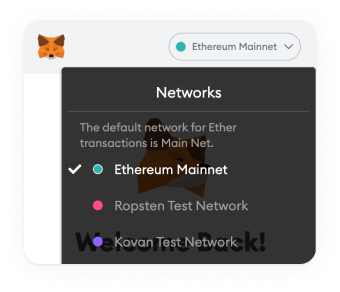

Extended Team: Developers. Launched the first medical technology pipeline, overseas ICO. Launched the first-generation smart wallet (AEN Connect) for testnet testing, and the first-generation Aenco blockchain was released for testnet testing. The second generation of custody wallets and custody services, the second overseas ICO of Pipeline Health Technology was released, the first generation of Aenco blockchain was launched, and a new AEN smart contract was generated; ERC223 tokens were replaced, and the blockchain supports 2-3 specific business points piece. Launched the third medical technology pipeline, overseas ICO.

Private sales begin in June. Ainas Capital has obtained a license from the Securities and Futures Commission of Hong Kong to deal in securities and provide advice on securities, and is promoted by industry investors. Pre-Overseas ICO sale starts in July: A rebate program will be available for participating subscriptions.

Aeneas Group Capital Co., Ltd. was established in New Jersey, USA, to establish a broker-dealer regulated by the United States Financial Industry Regulatory Authority. (In progress) Aeneas Group establishes a full banking license in Europe (in progress).

Aeneas Capital began to expand the Hong Kong Securities and Futures Commission's license to include securities dealing and advising on securities. Aenes forges partnerships with other medtech companies. These companies specialize in neurological diseases, infectious diseases and robotic surgical tools. Set up overseas ICO process and goals, and promote the website.

Aeneas Group has established a medical technology partnership with Aptorum Group, a multi-disciplinary medical innovation platform based in Hong Kong.

Assets managed by Aenas are invested in healthcare private equity funds and direct investments.

Capital products generated positive returns during the subprime crisis.

Aeneas Capital obtained an asset management license from the Securities and Futures Commission (Hong Kong).

See More